Last updated: March 2025

Introduction

Broadly speaking, there are five types of life insurance:

- Life cover (this is sometimes called death cover);

- Income protection cover;

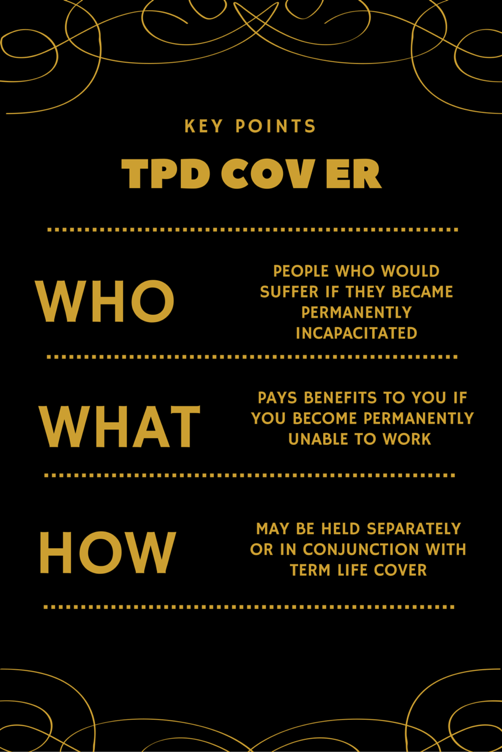

- Total and permanent disability cover (TPD);

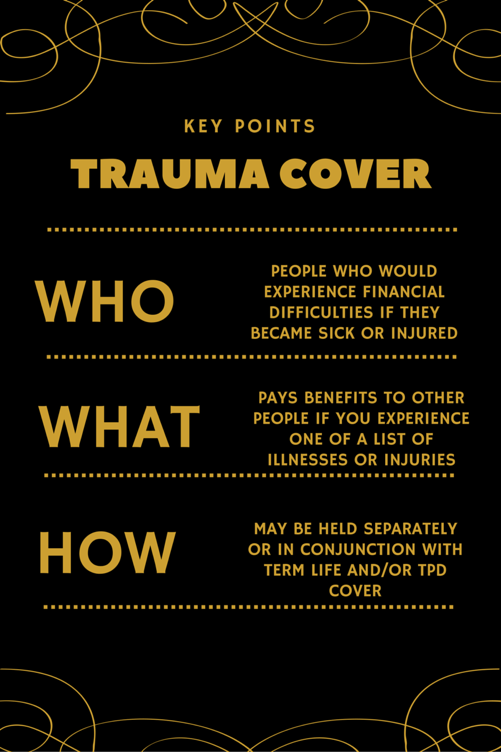

- Trauma cover; and

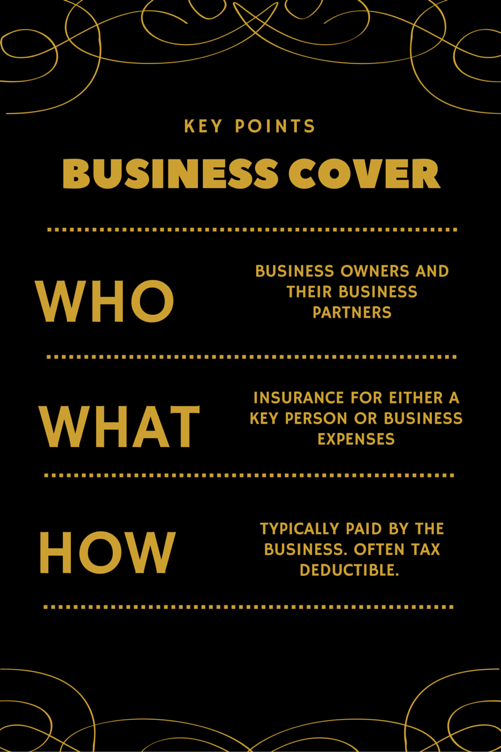

- Business cover (for either business expenses or a key person in the business).

We will look at each of these in turn. But before we do, let’s look at a few general concepts that apply to all or most forms of life insurance.

Chapter 1: Key Concepts in Life Insurance

Insurance is like a bet… and we hope you lose it!

In many respects, the concept of insurance can be likened to a wager, albeit one with a unique and perhaps counterintuitive objective: the hope that the insured event will not occur. The fundamental principle of insurance involves the policyholder paying a relatively modest sum, known as the premium, on a regular basis. This premium represents the ‘bet’. Should the ‘insured event’ transpire, the insurer then provides a payment to the policyholder or their designated beneficiaries. This payment is intended to mitigate the financial repercussions associated with the insured event.

Consider, for instance, life cover. This type of insurance policy is designed to provide a financial benefit upon the death of the insured individual. It is commonly sought by individuals who have financial responsibilities towards others, such as parents raising families. In the unfortunate event of a parent’s death, the household would face a significant loss of income, potentially jeopardizing the financial well-being of the children. To address this potential vulnerability, parents pay a regular premium to an insurer. If the ‘insured event’ – the death of the parent – occurs, the insurer pays the agreed-upon sum to the beneficiaries of the policy, thereby providing a measure of financial support to the surviving family members. The premium paid is the ‘bet’, and the preferred outcome is to ‘lose’ this bet, signifying that the insured individual has not passed away. However, should the insured event occur, the financial security of their loved ones is at least partially assured.

The Premium

The premium is the payment made by the policyholder to the insurer in exchange for the insurance coverage. There are two primary structures for premium payments: stepped premiums and level premiums. It is important to note that the terminology used to describe these premium types has been updated within the Australian life insurance industry. By December 31, 2024, new retail life insurance policies are required to use the terms “variable age-stepped” for what was previously known as stepped premium, and “variable” for what was previously known as level premium 1.

A variable age-stepped premium is one that typically increases each year. The amount of the premium is adjusted annually to reflect the changing probability of the insured event occurring. For example, with life cover, the likelihood of death generally increases with age. Consequently, a variable age-stepped premium for life cover will usually rise each year as the insured individual gets older. The insurer requires a higher premium to account for the increased risk of having to pay out on the policy 1.

The other main type of premium is a variable premium. As the name suggests, with this structure, the amount paid each year generally remains constant and does not increase due to the policyholder’s age 1. While the premium amount might be higher in the initial years of the policy compared to a variable age-stepped premium, it offers the advantage of predictability. Over time, a variable premium often becomes more cost-effective than a variable age-stepped premium, as the latter continues to increase with age. The new term “variable” acknowledges that while these premiums don’t increase due to age, they can still change due to other factors such as insurer repricing, indexation, or broader economic conditions 2.

The decision of whether to opt for a variable age-stepped or a variable premium is a matter best discussed with a financial advisor. Variable age-stepped premiums generally offer lower initial costs, which can be appealing for individuals who prioritize immediate affordability and wish to allocate funds to other needs like mortgage payments or children’s education. However, variable premiums provide certainty regarding future costs, allowing for better long-term financial planning. They can also prove to be more economical in the long run. Individuals who anticipate rising living costs may find the stability of a variable premium particularly attractive. The change in terminology aims to better reflect how premiums change over time, making the decision-making process clearer for customers 1.

Table 1.1: Premium Terminology Update

| Old Term | New Term (as of December 31, 2024) | Description |

| Stepped Premium | Variable Age-Stepped Premium | Premiums increase each year based on age and potentially other factors like claims trends. |

| Level Premium | Variable Premium | Premiums do not increase due to age but can change due to insurer repricing, indexation, or economic conditions. |

Underwriting

When an individual applies for a life insurance policy, the insurance company conducts a process known as underwriting. Essentially, underwriting involves evaluating the risk associated with insuring the applicant. The primary goal of this process is to determine the likelihood of the ‘insured event’ occurring.

For life cover, the underwriting process assesses the probability of the applicant dying during the policy’s term. To achieve this, the underwriter considers various factors related to the applicant’s lifestyle (for instance, participation in high-risk recreational activities), health history, age, and other pertinent details. While insurers operate based on probabilities and cannot predict future events with absolute certainty, they can establish a reasonable assessment of the likelihood of a claim.

Based on the underwriting assessment, the insurer may take one of four courses of action.

Firstly, they may accept the policy without any modifications. In this scenario, the policyholder simply pays the premium, and the insurer is obligated to provide the agreed-upon benefit if the insured event occurs.

Secondly, the insurer might accept the policy but impose an exclusion. This means that the policy will not pay out in specific circumstances deemed to be of higher risk. For example, if an applicant engages in activities like skydiving, the insurer might exclude death or injury resulting from skydiving. However, the policy would still provide coverage for death or injury due to other causes.

Thirdly, the insurer may accept the policy but increase the premium to reflect a higher likelihood of a claim. This is known as a loading. The principle is straightforward: the applicant is required to pay a higher premium to compensate for the elevated risk they present.

Fourthly, in cases where the underwriter determines that the probability of the insured event occurring is excessively high, the insurer may decline to offer insurance altogether. An example of this might be an individual with a terminal illness applying for life insurance, where the insurer would almost certainly face a claim.

Factors that affect under-writing and the premium

Several factors influence the underwriting process and the premium charged.

Age is a significant factor; generally, younger individuals pay lower premiums for life insurance. The exception to this trend can sometimes be very young men, who may face higher premiums due to statistical data related to risky driving behaviours. The rationale is that younger people tend to experience fewer health issues and have a lower mortality rate compared to older individuals, thus representing a lower risk to the insurer.

Gender also plays a role, as women, on average, have a longer life expectancy than men, which often translates to lower premiums for women.

Health is another crucial determinant; healthier individuals are typically offered lower premiums due to their reduced risk of illness or injury leading to a claim.

Smoking is a well-established risk factor, and smokers invariably pay higher life insurance premiums due to the increased likelihood of health problems and premature death. This highlights an additional financial benefit of quitting smoking.

While most occupations do not significantly impact premiums, certain professions deemed to be inherently more dangerous may attract higher premiums or even lead to a refusal of coverage. For instance, individuals in extremely high-risk occupations might face challenges in obtaining life insurance. Neil Armstrong, for example, could not get life insurance before he flew to the moon.

Recent regulatory changes and market trends have also impacted underwriting practices. Notably, the Australian government implemented a ban on the use of adverse genetic test results in life insurance underwriting, effective from September 2024 3. This reform aims to encourage individuals to undergo health-related genetic testing without the fear that negative results will negatively affect their ability to obtain life insurance coverage, including life cover, TPD, trauma, and income protection 3. This ban formalises a previous industry moratorium on genetic testing 5.

Furthermore, underwriting guidelines have been updated in response to the COVID-19 pandemic. As of June 2022, for life and trauma cover, individuals with asymptomatic, mild, or moderate COVID-19 infections who have fully recovered are generally accepted at standard rates, and the previous one-month deferral period has been removed 6.

There is also a discernible trend towards streamlining the underwriting process. For example, TAL introduced changes in October 2024 to reduce the reliance on mandatory medical tests for younger applicants seeking life, TPD, and income protection insurance, aiming to provide faster access to coverage 4. This suggests a broader industry move towards leveraging data and technology to make the application process more efficient 7.

Your Duty of Disclosure

A fundamental principle of insurance contracts is the duty of utmost good faith, which requires individuals applying for insurance cover to disclose all relevant information to the insurer.

Most insurance policies stipulate that the contract may be voided by the insurer if the insured person fails to disclose any information that is considered ‘material’ to the underwriting decision. Information is deemed ‘material’ if its disclosure could have influenced the insurer’s decision regarding whether to offer coverage or on what terms.

Therefore, it is crucial for applicants to provide honest and complete answers to all questions asked by the insurer. Failure to do so can undermine the very purpose of having insurance, as it could lead to the insurer refusing to pay a claim.

Affordability

For many individuals, the primary consideration when it comes to life insurance is affordability. Insurance premiums can represent a significant expense, and allocating funds to a product that one hopes never to use can sometimes seem like a low priority.

Consequently, ensuring that life insurance is as affordable as possible is paramount. Several strategies can help make insurance more accessible from a cost perspective.

One approach is to utilise superannuation benefits to pay for certain types of insurance available within super funds, typically including life cover, TPD, and a limited amount of income protection. While this does not necessarily reduce the overall cost, it can alleviate the impact on day-to-day cash flow by using funds that are not readily accessible anyway.

Another avenue for reducing the financial burden of insurance is to claim tax deductions where applicable. Premiums for some life insurance types, particularly income protection, are often tax-deductible. Additionally, some life cover and TPD premiums, especially for self-employed individuals, can be effectively tax-deductible through superannuation contributions that reduce taxable income.

Accepting a degree of under-insurance can also make premiums more manageable. Under-insurance refers to having a level of coverage that is lower than what might typically be recommended based on one’s financial situation and responsibilities. While it is generally advisable to have an appropriate level of insurance, obtaining some coverage, even if it is less than ideal, is often better than having no insurance at all if affordability is a significant constraint.

Another way to lower premiums is by accepting a portion of the risk yourself. For instance, with income protection, choosing a policy with a longer waiting period (the time one must be unable to work before benefits commence) can substantially reduce premiums. If an individual believes they could manage financially for a certain period, such as a year, if they became unwell, opting for a one-year waiting period could make the policy much more affordable compared to a policy with a shorter waiting period.

Finally, it is always prudent to obtain multiple quotes from different insurers and to avoid being overly loyal to a single provider. Significant savings can often be achieved by comparing policies and selecting the one that offers the best value for money.

Financial advisers can assist in this process and are knowledgeable about other strategies to ensure premiums are as affordable as possible, making affordability a key factor in their advice.

Continuity

When considering switching insurance providers, it is essential to ensure that coverage seamlessly continues from the old policy to the new one. Financial advisers can provide valuable assistance in this transition. The aim is to avoid any gaps in coverage, as the occurrence of an insured event during such a gap could leave the individual without financial protection.

Tell people you have the policy

Upon taking out a life insurance policy, it is crucial to inform trusted individuals about its existence. This should include, at a minimum, the executor of one’s estate, as well as one’s partner and close friends or relatives. The reason is simple: if an insurance policy exists but no one is aware of it, and the insured event occurs preventing the policyholder from communicating this information, a claim might never be made. This is particularly relevant for life cover, where, after death, the insured individual cannot inform anyone about the policy.

The same principle applies to other important documents such as wills and mortgage papers. Ensuring that loved ones and the executor (if appointed) know the location of these documents is vital. Storing digital copies can be effective, especially for individuals who move frequently, although original signed copies of legal documents like wills are still necessary for the executor.

Chapter 2: Life Cover

As previously mentioned, life cover is an insurance policy that provides a financial payment to designated beneficiaries upon the death of the insured person.

The most prevalent form of life cover is term life insurance. This type of policy pays an agreed-upon benefit if the insured person dies or is diagnosed with a terminal illness. The maximum age at which insurers will continue to provide coverage varies, but it typically extends up to ages ranging from 70 to 79, with some policies offering cover until age 80 or even 85 9.

Most term life policies include a terminal illness benefit, which allows for a payout if the insured individual is diagnosed with a terminal condition and has a life expectancy of less than 12 months 10. Some policies may offer a partial benefit payment in such circumstances, while others allow for the entire benefit amount to be paid out.

The word ‘term’ in ‘term life insurance’ signifies that the policy is in effect for a specific duration, known as the ‘term’ of the policy. This term is often one year, and for the policy to remain active beyond this period, the client typically needs to renew it annually.

Renewing the policy

Traditionally, most risk insurance policies, including term life insurance, are guaranteed renewable 14. This means that the insurer is obligated to renew the policy each year, irrespective of any changes in the policyholder’s health, employment status, or personal circumstances that may have occurred since the policy was initially taken out. This feature is particularly important in cases of ill health that develop after the policy’s inception. Due to guaranteed renewability, even if an insured person’s health deteriorates, the insurer must continue to renew the policy as long as the health changes occurred after the policy commenced.

Who gets the benefit?

Most term life policies allow the policyholder to nominate the individual or individuals who should receive the benefit payment in the event of their death. If no beneficiary is formally nominated, the insurer typically has the discretion to decide who should receive the payment. In most cases, the insurer will pay the benefit to the deceased’s estate, and the executor of the estate will then be responsible for distributing the funds according to the deceased’s will.

Who uses Life Cover?

Individuals who should typically consider taking out life cover include:

- Parents who are still raising their children.

- Prospective parents who are trying to conceive or who are already pregnant.

- Husbands or wives (whether married or in a de facto relationship) whose partner relies on their income.

- Anyone else who has financial dependants.

How to hold your life cover

Life cover can be held either personally or through a superannuation fund. If held personally, the premium is generally not tax-deductible. However, when held within superannuation, the premium is often effectively tax-deductible. When paying for life cover through superannuation, one can either use existing superannuation balances or, if permissible, make contributions to a specific fund for the purpose of purchasing the life cover.

When using superannuation to fund life cover, it is essential to ensure that a binding death benefit nomination is lodged with the superannuation fund. This informs the fund trustees about the policyholder’s wishes regarding who should receive the benefit upon their death. It is also important to remember that using superannuation to pay for life cover will reduce the overall superannuation balance, unless this reduction is offset by increased contributions. However, if using superannuation allows for the premiums to be effectively tax-deductible, the total amount paid for the cover will be reduced, which means the decrease in the superannuation balance will likely be more than compensated for by the increased wealth available outside of superannuation due to the tax savings. If these tax savings are reinvested, the individual will ultimately have more overall wealth.

More information

To learn more about Life Cover, please visit the ASIC website here.

Chapter 3: Income Protection Cover

Income protection insurance, as its name suggests, is designed to protect an individual’s personal income in the event that they become unable to work due to illness or injury.

The fundamental idea is that if a person becomes sick or injured and cannot perform their job, any resulting loss of income can be compensated for by the insurance policy.

What income can I insure?

Insurers typically only allow individuals to insure income that is directly derived from their labour, often referred to as ‘personal exertion‘ income. This is the income that would cease if the insured person were unable to work. ‘Passive’ income, such as income generated from assets that do not require active management (e.g., shares or investment properties), is generally not insurable. However, this is usually not a concern, as passive income typically continues even if the individual cannot work.

Income protection insurance can be complex, primarily because of the wide variety of features offered by different providers. Furthermore, the same insurer may offer varying terms to individuals with different income structures. It is advisable to discuss specific income protection needs with a financial advisor, who can help arrange cover that is appropriate for an individual’s unique circumstances.

How long are benefits paid for?

One of the key ways in which income protection policies differ is the benefit period, which is the duration for which the insurer will pay income protection benefits. Common benefit periods include one year, two years, five years, or until the insured person reaches a specified age, such as 60 or 65. Generally, policies with shorter benefit periods have lower premiums.

Waiting period

Income protection policies often offer the option to adjust the waiting period, which is the initial period after becoming unable to work during which no benefits are paid. For example, an individual might choose a policy with a 30-day waiting period. If they are unable to work for less than 30 days, no benefit is paid. However, if the period of inability to work extends beyond 30 days, benefits typically commence from the 31st day.

Choosing a longer waiting period generally results in lower premiums because it reduces the likelihood that a benefit will be paid. People are statistically less likely to be out of work for extended periods, so insurers are less likely to make a payment on a policy with a longer waiting period.

Limits on benefits paid

Income protection benefits are typically capped at a maximum of 75% of the individual’s pre-disability income. Many insurers calculate this pre-disability income based on the average income earned over the two years preceding the illness or injury. They will then pay up to 75% of this average amount.

Additionally, most insurers impose an ‘absolute’ upper limit on the monthly benefit payable. For instance, if a policy has an absolute limit of $12,000 per month, this is the maximum amount an individual can receive, regardless of their pre-disability income.

Agreed value or indemnity

Historically, income protection policies were available as either agreed value or indemnity policies. An agreed value policy allowed the insured amount to be established at the time the policy was taken out. These policies were often favoured by individuals with variable incomes, such as consultants or casual workers, whose earnings might fluctuate. When an agreed value policy was initiated, the individual had to demonstrate that the insured amount was realistic based on their current income. Once established, this amount would be paid out in the event of a valid claim, even if the individual’s income had decreased during the policy period, provided the change in income was considered ‘normal’.

However, as of March 2020, agreed value income protection policies are no longer available for new policies 15. This change was driven by concerns from the Australian Prudential Regulation Authority (APRA) regarding the sustainability of these policies due to substantial and ongoing losses experienced by insurers 15. APRA also raised concerns about the potential for moral hazard, where individuals might have less incentive to return to work, and the deviation from the fundamental principle of insurance, which is to indemnify against loss 16.

Currently, all new income protection policies are indemnity policies. If an individual holds an agreed value policy established before March 2020, it remains valid, and the terms under which it was purchased still apply. However, it is no longer possible to purchase a new agreed value income protection policy. Under an indemnity policy, the benefit paid is linked to the actual income earned in the period (typically 12 months) prior to the illness or injury occurring. Generally, the insurer will pay out between 70% and 75% of this lost income 18.

If an individual holds an indemnity policy and their income situation changes (e.g., they change or lose their job), it is crucial to inform their financial advisor immediately. This will help ensure that they are not paying excessive premiums for a sum insured that exceeds what the insurer would actually pay in the event of a claim. In addition to the discontinuation of agreed value policies, other significant changes have been implemented in the income protection market, including a maximum policy contract term of five years for new policies sold on or after September 27, 2021 18. This means that at the end of the five-year term, policyholders will be offered the income protection products available at that time.

Renewing income protection policy

It is important to note a change specifically related to income protection policies.

As of October 2021, new income protection policies have a limited guaranteed renewability period of five years. Within this five-year period, the insurer must renew the policy annually, provided the insured person pays the premium. After the initial five years, the insurer can consider changes in the individual’s income or personal circumstances when issuing a new policy, which will also have a maximum term of five years 15.

It is crucial to remember that even with these changes in income protection renewability, the insurer is not permitted to factor in changes to the insured person’s health status when conducting the five-year review. Therefore, if an illness or injury develops that could potentially lead to a claim, the insurer cannot refuse to issue a new policy based on this change in health. The insurer can only adjust aspects of the policy related to other circumstances, such as age or income.

Who needs income protection cover?

Any individual whose financial circumstances would be negatively impacted by a loss of income should consider taking out income protection cover. This includes people with financial dependants, such as parents, as well as those with financial commitments like mortgages and other debts.

Essentially, most people should consider income protection cover.

To learn more about Income Protection Cover, please visit the ASIC website here.

Superannuation and income protection

Many superannuation funds offer a small amount of ‘default’ income protection cover to their members without requiring a formal application. Members often have the option to increase this level of cover by applying to do so.

The availability of income protection within superannuation can make it more accessible from an affordability perspective, not necessarily because the insurance is cheaper within super, but because the premiums are paid from pre-tax superannuation contributions, thus easing the strain on day-to-day cash flow.

However, it is important to note that if income protection premiums are paid by a super fund, they are not tax-deductible to the insured person. Therefore, there are both advantages and disadvantages to using superannuation for income protection, and the best approach depends on an individual’s specific financial situation. Financial advisers can help clients determine whether using superannuation is the most suitable way to access this type of insurance.

Chapter 4: Total and permanent disability (TPD) cover

Total and permanent disability (TPD) cover provides insurance protection in the event that a person becomes physically or mentally unable to work and earn an income. This type of cover is frequently offered as part of the same policy as life cover, as the financial consequences of becoming totally and permanently disabled can be similar to those of death, particularly for individuals with financial responsibilities. For example, if a parent with dependent children becomes disabled and cannot work, the family faces a loss of income, similar to the situation following the death of a parent.

What does total and permanent disability mean?

The definition of total and permanent disability can vary slightly between different insurers 23. However, the core concept revolves around the insured person’s inability to ever work again due to illness or injury 25. For instance, Aware Super defines TPD cover as providing a benefit if a member becomes totally and permanently disabled due to illness or injury and is unlikely ever to work again 25.

Own occupation versus any occupation

TPD insurance can provide cover based on two main definitions: ‘own occupation’ or ‘any occupation’ 28.

‘Own occupation’ cover typically means that the insured person is unable to work in their specific occupation due to disability 27. For example, if a plumber becomes paralysed and can no longer stand, they would likely be unable to continue their occupation as a plumber, even if they might be capable of performing other types of work 28. It is important to note that the definition of ‘occupation’ is broader than just the immediate job tasks and considers the individual’s qualifications, experience, and work history 32. ‘Own occupation’ cover generally offers a higher chance of claim approval but tends to have higher premiums and is typically available outside of superannuation 28.

‘Any occupation’ cover, on the other hand, has a slightly more stringent definition. It typically means that the insured person is unable to engage in any work for which they are reasonably suited by their education, training, or experience 28. For instance, in the previous example, if the paralysed plumber could still perform a desk job related to the plumbing industry, they might not meet the definition of ‘any occupation’ TPD 28. ‘Any occupation’ cover generally has lower premiums but may be more challenging to claim on as the criteria are broader 28. This type of cover is commonly offered through superannuation funds 31. Besides these two primary definitions, some policies may also offer cover based on the inability to perform ‘home duties’ or ‘activities of daily living’ 24.

Under-writing

The underwriting process for TPD insurance is similar to that for life cover. Insurers assess the likelihood of the applicant becoming disabled in the future by considering similar risk factors as those used for life cover, such as participation in risky activities.

As with life cover, most insurers do not provide coverage for disabilities resulting from pre-existing conditions. Therefore, applicants are usually required to undergo medical tests and complete detailed questionnaires before TPD cover is provided.

Similarly, most TPD policies exclude disabilities that are self-inflicted. Insurers also tend to be cautious about offering TPD policies where the insured person might be financially better off being disabled, as this could create a potential for fraudulent claims. Consequently, most insurers verify an applicant’s income before offering TPD cover, and if the income is low, the amount of TPD cover offered may also be limited.

Certain occupations known to have a higher risk of injuries may also attract higher premiums for TPD cover.

Who needs TPD cover?

Individuals who require life cover generally also have a need for TPD cover, as the financial implications of becoming disabled and unable to work can often be more severe than those following a death. Furthermore, individuals who are personally dependent on their continued good health for their livelihood should strongly consider TPD cover.

Chapter 5: Trauma Cover

Trauma insurance, also sometimes referred to as critical illness insurance or recovery insurance, provides a lump sum payment if the insured person suffers a specified illness or experiences a specified event, regardless of the long-term consequences of that event 14. For instance, if an individual has a heart attack that does not result in death or total and permanent disability, they would not receive a payout from a standard life cover or TPD policy. Trauma cover addresses this gap by providing a benefit upon the occurrence of a defined traumatic event, helping to cover potential loss of income and significant expenses such as medical treatment and rehabilitation 19.

The list of illnesses and events covered by trauma insurance varies from policy to policy, but typically includes conditions like heart attack, stroke, and cancer 19. To receive a benefit, the insured person only needs to prove that the specified illness or event occurred; they do not need to demonstrate that it had severe long-term consequences like permanent disability 36. Upon a successful claim, a lump sum amount, which is usually specified in the policy, is paid out. Most trauma policies include a survival period clause, typically requiring the insured person to live for a designated period, often 14 days, after the traumatic event 19. This means that if a person dies shortly after suffering a heart attack, a trauma benefit might not be payable to their estate, although a death benefit might be payable if the individual also held a life cover policy. Trauma insurance can often be combined with term life insurance and/or TPD insurance within the same policy 19.

The list of illnesses and events covered by trauma insurance varies from policy to policy, but typically includes conditions like heart attack, stroke, and cancer 19. To receive a benefit, the insured person only needs to prove that the specified illness or event occurred; they do not need to demonstrate that it had severe long-term consequences like permanent disability 36. Upon a successful claim, a lump sum amount, which is usually specified in the policy, is paid out. Most trauma policies include a survival period clause, typically requiring the insured person to live for a designated period, often 14 days, after the traumatic event 19. This means that if a person dies shortly after suffering a heart attack, a trauma benefit might not be payable to their estate, although a death benefit might be payable if the individual also held a life cover policy. Trauma insurance can often be combined with term life insurance and/or TPD insurance within the same policy 19.

Recent updates to trauma cover include improvements to the definitions of certain conditions. For example, Zurich Wealth Protection updated its Angioplasty (triple vessel) definition to cover angioplasty of all arteries and their branches, and removed an exclusion for certain thyroid cancers within its Cancer (excluding early-stage cancers) definition, effective from February 2025 38. These changes aim to provide broader and more relevant coverage to policyholders.

Who uses trauma cover?

Trauma cover tends to be less popular than life cover or income protection. This is partly because many individuals also have health insurance that covers some or all of the costs associated with illness, or income protection that provides financial support in case of income loss due to illness or injury. Nevertheless, there are situations where trauma cover is particularly beneficial.

For example, individuals who are not working may not be eligible for income protection, or those working part-time may not be able to obtain a significant level of income protection. This might include stay-at-home parents or those taking a break from paid employment. In such cases, trauma cover can provide a financial benefit to cover medical expenses and other costs if a traumatic event occurs. It is advisable to discuss the need for trauma cover with a financial advisor to determine if it is appropriate for one’s specific circumstances.

To learn more about Trauma Cover, please visit the ASIC website here.

Chapter 6: Business Cover

Businesses should consider two primary forms of life insurance: key person insurance and business expense insurance.

Key person insurance

Key person insurance is a policy taken out by a business to cover the financial impact of the death or disability of a key individual within the organization 19. Essentially, it functions as life and/or TPD cover where the business is the beneficiary. This type of insurance is often purchased by business partners. The purpose is that if one of the partners dies or becomes disabled, the business will receive a sum of money that can be used to buy out the deceased or injured partner’s share of the business. This allows the remaining partners to continue operating the business without facing severe financial strain.

The amount of coverage is typically determined based on the potential financial loss the business would incur due to the absence of the key person. This will vary depending on the specific circumstances of the business, making it essential to discuss key person insurance needs with a financial advisor to understand its potential benefits.

Business expense insurance

Business expense insurance is often utilized by smaller businesses where the operational expenses would continue even if the principal is unable to work due to illness or injury. A common example is a self-employed tradesperson, such as a builder, who might become injured or ill and unable to generate income. However, the business’s fixed costs, such as office rent, vehicle expenses, insurance premiums, and staff salaries, would still need to be paid. Business expense insurance helps cover these ongoing costs during the period the business owner is unable to work, ensuring the business can remain viable until they recover.

The specific amount and type of business expense insurance required will depend on the unique characteristics of the business, which is why it is recommended to discuss these needs with a financial adviser.

Chapter 7: References

- https://www.onepath.com.au/customers/clarity/the-price-of-your-cover/what-is-the-difference-between-stepped-and-level-premiums.html

- Navigating the Shift in Life Insurance Premium Terminology: What Advisers Need to Know, accessed March 21, 2025, https://riskhub.com.au/articles/navigating-the-shift-in-life-insurance-premium-terminology-what-advisers-need-to-know/

- Government bans use of genetic test results in life insurance – MinterEllison, accessed March 21, 2025, https://www.minterellison.com/articles/government-bans-use-of-genetic-test-results-in-life-insurance

- TAL cuts medical tests to streamline underwriting process | Insurance Business Australia, accessed March 21, 2025, https://www.insurancebusinessmag.com/au/news/life-insurance/tal-cuts-medical-tests-to-streamline-underwriting-process-509634.aspx

- Use of Genetic Testing Results in Life Insurance Underwriting – Financial Services Council, accessed March 21, 2025, https://www.fsc.org.au/resources/2688-fsc-submission-genetic-tests/file

- Changes to Covid Underwriting guidelines – Advisers – Zurich Australia, accessed March 21, 2025, https://advisers.zurich.com.au/news/adviser-news/2022/changes-to-covid-underwriting-guidelines

- AU gains momentum as insurers tackle mortality and efficiency – Gen Re, accessed March 21, 2025, https://www.insurancebusinessmag.com/au/news/reinsurance/au-gains-momentum-as-insurers-tackle-mortality-and-efficiency–gen-re-513715.aspx

- Life insurance top trends 2025 – Capgemini Australia, accessed March 21, 2025, https://www.capgemini.com/au-en/insights/research-library/life-insurance-top-trends-2025/

- Life Insurance Australia | Get A Quote Online – TAL, accessed March 21, 2025, https://www.tal.com.au/life-insurance

- Life cover – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/life-cover

- Term Life Insurance in Australia | Is it right for you? – Finder, accessed March 21, 2025, https://www.finder.com.au/life-insurance/term-life-insurance

- Life cover – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/life-cover

- Term Life Insurance in Australia | Is it right for you? – Finder, accessed March 21, 2025, https://www.finder.com.au/life-insurance/term-life-insurance

- Best Life Insurance Policies in Australia in 2025 | Canstar, accessed March 21, 2025, https://www.canstar.com.au/life-insurance/compare/best-life-insurance/

- Income protection insurance – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/income-protection-insurance

- Agreed value income protection (RIP) – Finder, accessed March 21, 2025, https://www.finder.com.au/income-protection/agreed-value

- Income protection insurance – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/income-protection-insurance

- Individual Disability Income Insurance (IDII) | Zurich Australia – Advisers, accessed March 21, 2025, https://advisers.zurich.com.au/resources/change-navigator/individual-disability-income-insurance

- Types of life insurance in Australia – Finder, accessed March 21, 2025, https://www.finder.com.au/life-insurance/types-of-life-insurance

- The 4 types of life insurance and when you need them – Zurich Australia, accessed March 21, 2025, https://www.zurich.com.au/latest-news/magazine/types-of-life-insurance.html

- Four types of life insurance explained and how to choose – Zurich Australia, accessed March 21, 2025, https://www.zurich.com.au/latest-news/magazine/lgbtq-hub/four-types-of-life-insurance-explained.html

- Types of Life Insurance in Australia | Canstar, accessed March 21, 2025, https://www.canstar.com.au/life-insurance/types-life-insurance-australia/

- TPD Insurance In Australia: What You Need To Know – Business for Doctors, accessed March 21, 2025, https://businessfordoctors.com/tpd-insurance-in-australia-what-you-need-to-know/

- TPD Definition: Guide to Total and Permanent Disability Insurance – Aussie Injury Lawyers, accessed March 21, 2025, https://aussieinjurylawyers.com.au/legal-news/total-permanent-disability-tpd-definition/

- Total and permanent disablement cover | Aware Super – Australian Superannuation Fund, accessed March 21, 2025, https://aware.com.au/member/what-we-offer/insurance/types-of-cover/total-and-permanent-disablement-cover

- What Qualifies as Total and Permanent Disability?, accessed March 21, 2025, https://aussieinjurylawyers.com.au/legal-news/what-does-total-and-permanent-disability-mean/

- TPD – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/total-and-permanent-disability-tpd-insurance

- Total and permanent disability – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/total-and-permanent-disability-tpd-insurance

- Own Occupation vs Any Occupation in TPD Insurance – Aussie Injury Lawyers, accessed March 21, 2025, https://aussieinjurylawyers.com.au/legal-news/the-difference-between-own-occupation-and-any-occupation-in-total-and-permanent-disability-insurance/

- Any vs. Own Occupation TPD Policies: What’s the Difference?, accessed March 21, 2025, https://monacosolicitors.com.au/faq/what-is-the-difference-between-any-occupation-and-own-occupation-tpd-definitions/

- Total and permanent disability – Moneysmart.gov.au, accessed March 21, 2025, https://moneysmart.gov.au/how-life-insurance-works/total-and-permanent-disability-tpd-insurance

- Own Occupation Total and Permanent Disability: Meaning of in a life policy (Australia), accessed March 21, 2025, https://www.financialinstitutionslegalsnapshot.com/2024/11/08/own-occupation-total-and-permanent-disability-meaning-of-in-a-life-policy-australia/

- A job is not an occupation – the Supreme Court of NSW clarifies what is a life insured’s “occupation” under an “Own Occupation” TPD definition – HWL Ebsworth Lawyers, accessed March 21, 2025, https://hwlebsworth.com.au/a-job-is-not-an-occupation-the-supreme-court-of-nsw-clarifies-what-is-a-life-insureds-occupation-under-an-own-occupation-tpd-definition/

- ‘Own’ versus ‘Any’ occupation: an important difference when comparing Income Protection products – Ensombl, accessed March 21, 2025, https://ensombl.com/articles/own-versus-any-occupation-an-important-difference-when-comparing-income-protection-products/

- NEOS Protect: Home, accessed March 21, 2025, https://www.neosprotect.com.au/

- OneCare Trauma Cover – OnePath, accessed March 21, 2025, https://www.onepath.com.au/life-insurance/products/recovery-money/onecare-trauma-cover.html

- Trauma cover – top 3 things to know – OnePath, accessed March 21, 2025, https://www.onepath.com.au/customers/clarity/types-of-life-insurance/top-3-things-you-need-to-know-about-trauma-cover.html

- February 7 Product Updates – Advisers – Zurich Australia, accessed March 21, 2025, https://advisers.zurich.com.au/resources/change-navigator/feb7-product-updates